Consider what happens when a senior tax specialist can’t quickly locate last year’s approach to a complex client situation, or when a new hire spends hours searching for the firm’s accounts receivable process. These scenarios aren’t just frustrating; they’re expensive.

Accounting professionals spend a significant portion of their workweek simply searching for information needed to do their jobs effectively. This lost productivity translates directly to billable hours that could be better spent serving clients.

Knowledge silos between departments create additional friction. When tax, audit, and advisory teams can’t easily access each other’s documentation, it leads to duplicated efforts and inconsistent approaches. Meanwhile, client expectations for rapid, accurate responses continue to rise.

Perhaps most concerning is the compliance risk. Documentation issues consistently rank among the leading causes of professional liability claims against accounting firms. When guidance on tax regulations or audit procedures isn’t properly documented and accessible, mistakes become inevitable.

AllyMatter’s internal knowledge base platform addresses these challenges by centralizing critical documentation, streamlining compliance processes, and enhancing collaboration across accounting teams. Let’s explore how.

Centralizing critical accounting documentation

The foundation of effective knowledge management in accounting begins with centralization. Rather than having financial policies scattered across multiple systems, AllyMatter creates a single, searchable repository that becomes your firm’s definitive source of truth.

For accounting firms, this means organizing documentation according to logical hierarchies that reflect how your teams actually work. For example:

- Accounts Payable

- Vendor setup process

- Invoice approval workflow

- Payment processing procedure

- Accounts Receivable

- Client billing process

- Collections procedure

- Revenue recognition guidelines

AllyMatter’s intuitive WYSIWYG editor eliminates complex document formatting issues, allowing your team to focus on content rather than presentation. This means your financial documentation becomes more consistent and easier to maintain.

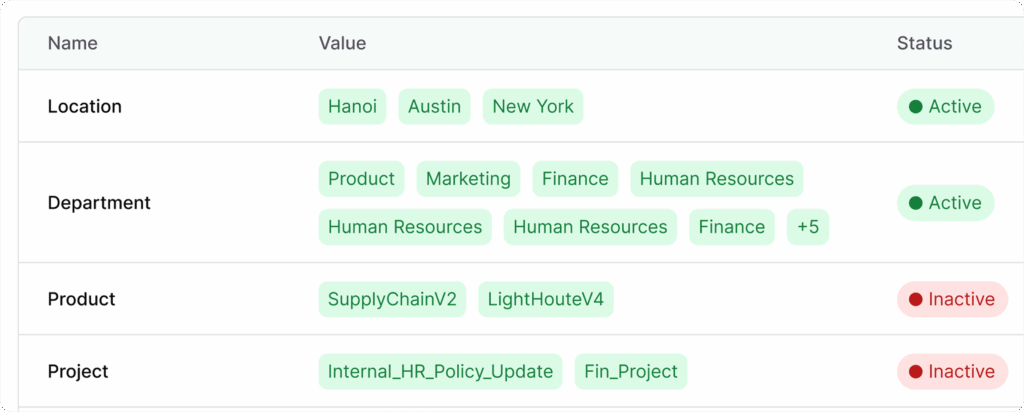

The platform’s smart tagging capabilities enable you to categorize content based on specific departments, geographies, or custom parameters relevant to your firm. For instance, tax documentation might be tagged with “Finance-Tax” while SOX compliance documentation uses “Finance-Compliance-SOX” to ensure proper visibility to compliance teams and auditors.

With everything in one place, your team spends less time tracking down information and more time applying their expertise to client challenges.

Streamlining compliance and maintaining audit readiness

Accounting firms operate in a highly regulated environment where compliance isn’t optional. AllyMatter helps establish documentation practices that keep your firm audit-ready at all times.

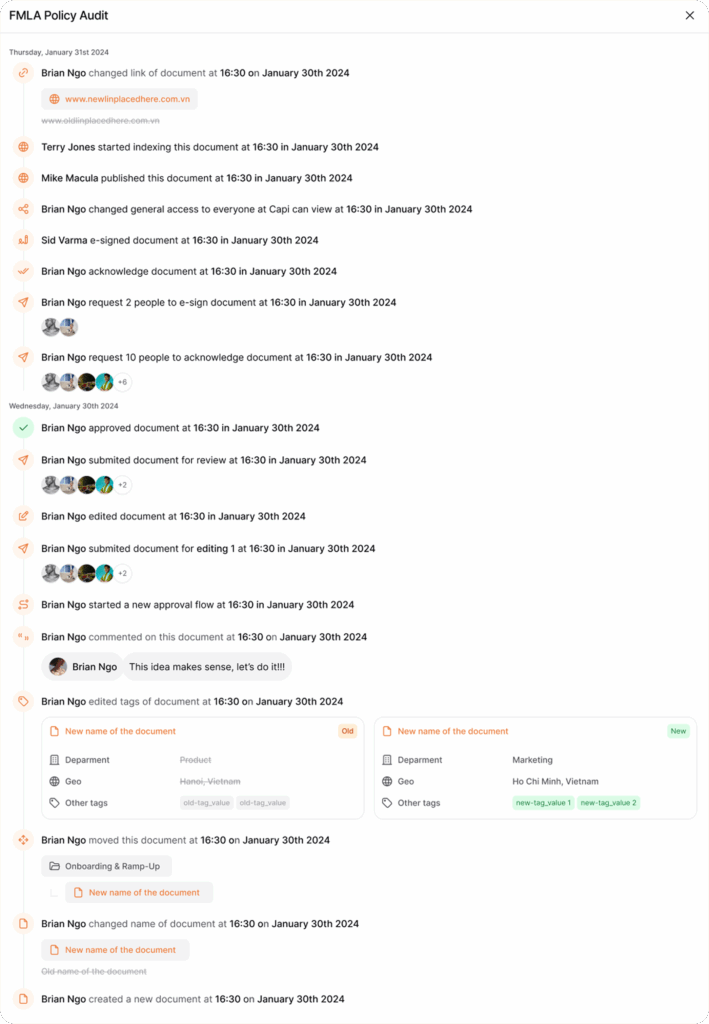

One of the most valuable features for accounting professionals is comprehensive version tracking. Every edit, update, and action on your documents is logged with detailed audit trails. This means you can:

- Track exactly who made changes to critical financial documentation.

- See a chronological log of all document modifications.

- Compare versions to identify specific edits and updates.

- Restore previous versions if needed.

- Simplify compliance with searchable change history.

Read more: Manage Documentation Audit & History with AllyMatter

For firms dealing with regulatory requirements like SOX compliance, these audit capabilities aren’t just convenient; they’re essential. When auditors request documentation of your processes, you can quickly produce not just the current procedures, but the complete history of how those procedures have evolved.

AllyMatter’s approval workflows ensure that financial documents follow proper review protocols before being finalized. This prevents unauthorized changes to critical procedures and maintains the integrity of your financial documentation.

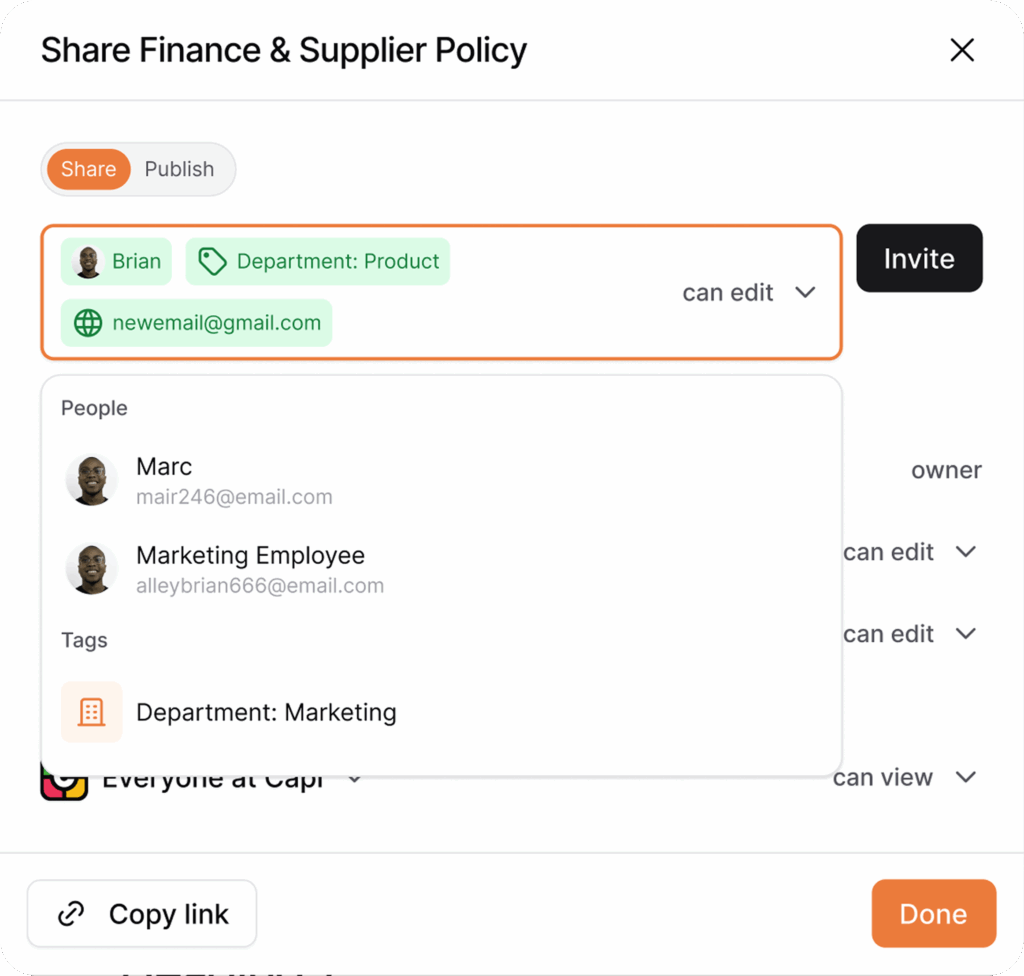

Additionally, the platform’s granular access controls allow you to define exactly who can view, edit, or approve different types of financial documentation. This ensures sensitive information remains protected while still allowing team members appropriate access to the resources they need.

Bridging knowledge gaps between senior and junior staff

One of the greatest challenges facing accounting firms today is the transfer of knowledge between generations of professionals. With a significant portion of experienced CPAs approaching retirement age in the coming years, there’s an urgent need to capture institutional knowledge before it walks out the door.

Consider Susan, a senior tax manager at a mid-sized firm, who spent three hours recreating a complex depreciation analysis for a manufacturing client because the original methodology wasn’t documented anywhere. When the client called with follow-up questions six months later, the new associate assigned to the account had no context for the decisions made.

AllyMatter provides a structured way to document the expertise of senior accountants, making it accessible to newer team members. Rather than relying solely on one-on-one mentoring (which remains valuable but limited in scale), firms can systematically capture:

- Nuanced interpretations of complex tax code provisions

- Preferred approaches to handling specific client scenarios

- Best practices for managing audit processes

- Shortcuts and efficiency tips developed through years of experience

For new hires, an internal knowledge base dramatically accelerates onboarding. Instead of piecing together processes through observation and trial-and-error, junior accountants can access comprehensive documentation that guides them through firm-specific procedures.

This documentation culture shifts your firm away from over-reliance on individual expertise toward a more resilient model where knowledge is shared as an organizational asset. When a senior accountant retires or leaves, their expertise doesn’t disappear. It remains accessible in your knowledge repository.

Enhancing collaboration across financial teams

Modern accounting firms rarely operate in isolation. Projects frequently require collaboration across specialties, with tax professionals, auditors, and advisory services working together to serve clients.

AllyMatter enhances this collaboration by providing secure spaces where teams can work together on documentation while maintaining appropriate access controls. For example:

When preparing complex tax structures for multinational clients, teams from different specialties can collaborate on documentation while maintaining version control. Each contributor can see who made specific changes and why, preventing confusion or conflicting guidance.

The platform also facilitates external collaboration without compromising security. When working with external auditors, you can grant limited access to specific documentation without exposing your entire knowledge base. The platform’s enterprise-grade encryption protects sensitive client information, addressing a critical concern for accounting firms.

For firms with multiple offices, AllyMatter eliminates geographic barriers to knowledge sharing. A documented tax strategy developed by your New York team becomes immediately available to colleagues in Chicago or Los Angeles, ensuring consistent service delivery regardless of location.

Accelerating decision-making with instant access to financial information

In accounting, timely access to accurate information often determines the quality of service you provide to clients. When a client calls with an urgent tax question or compliance concern, your team’s ability to respond quickly and confidently directly impacts client satisfaction.

AllyMatter’s robust search capabilities transform how quickly your team can retrieve critical information. Rather than digging through email threads or shared drives, accountants can instantly locate relevant guidance, precedents, or procedures.

Accounting professionals save substantial time each week when working with properly organized knowledge management systems; time that can be redirected to higher-value client work.

This efficiency extends to approval processes as well. AllyMatter’s workflows reduce bottlenecks in document approvals, ensuring that time-sensitive financial documents move through review cycles promptly. When year-end closing procedures need updates or tax provision documentation requires approval, automated workflows ensure nothing falls through the cracks.

Beyond operational efficiency, centralized knowledge management improves the quality of financial decision-making. When your team has immediate access to the firm’s collective expertise, they can make more informed recommendations to clients. Instead of relying solely on individual knowledge, they can leverage documented insights from across the organization.

How to implement AllyMatter in your accounting firm

Implementing a knowledge management solution requires thoughtful planning. Here’s how accounting firms can effectively adopt AllyMatter:

- First, establish a clear logical hierarchy that aligns with your firm’s structure. For accounting firms, this typically means organizing by department (Tax, Audit, Advisory) and then by specific processes within each area.

- Next, leverage AllyMatter’s tagging capabilities to make documentation discoverable. Finance teams can use precise control over policy access through tags like “Finance-Standards-Global” for accounting standards documentation or “Finance-Compliance-SOX” for compliance documentation.

- Document visibility settings allow you to control exactly who can access different types of financial information:

- “Internal Users Only” for standard operating procedures

- “Private to User” for sensitive client-specific documentation

- “Fully Public” for general firm policies that everyone needs to access

- AllyMatter’s user management interface enables you to assign specific roles and permissions based on job functions. For instance, senior accountants might have editor privileges for tax documentation, while junior staff have viewer access until they’ve completed required training.

- Finally, establish governance protocols that determine how documentation will be maintained over time. Designate owners for different sections of your knowledge base and implement regular review cycles to ensure content remains current and accurate.

Taking the next step toward accounting excellence

Knowledge management isn’t just an operational improvement for accounting firms; it’s a strategic advantage. When your team can instantly access accurate, up-to-date information, they can focus on delivering exceptional client service rather than hunting down internal resources.

AllyMatter provides the structure and tools accounting firms need to centralize critical documentation, streamline compliance processes, bridge generational knowledge gaps, enhance team collaboration, and accelerate decision-making.

In today’s complex regulatory environment, with growing competition for both clients and talent, effective knowledge management has become a differentiator between accounting firms that merely survive and those that thrive.

Ready to transform your firm’s knowledge management? Join our waitlist to be among the first to experience how AllyMatter can address your specific knowledge management challenges.

Frequently asked questions

How does AllyMatter help accounting firms maintain SOX compliance?

AllyMatter provides comprehensive audit trails that track every document edit, update, and action with detailed logs. This includes chronological change history, version comparisons, and user activity tracking. The platform’s approval workflows ensure financial documents follow proper review protocols, while granular access controls define exactly who can view, edit, or approve different types of financial documentation.

Can AllyMatter integrate with existing accounting software like QuickBooks or Sage?

While AllyMatter serves as a centralized knowledge management platform, it’s designed to complement your existing accounting software stack. You can document processes related to your current tools and create standardized procedures for using them across your firm. The platform helps organize knowledge about your existing systems rather than replacing them.

How does AllyMatter protect sensitive client information?

AllyMatter employs enterprise-grade encryption for data both in transit and at rest, multi-factor authentication, and granular access controls. You can set document visibility to “Private to User” for sensitive client-specific documentation or “Internal Users Only” for standard procedures. The platform’s security measures are designed to meet the stringent requirements accounting firms face for protecting client data.

What’s the typical implementation timeline for an accounting firm?

Implementation varies based on firm size and complexity, but most accounting firms can establish their basic knowledge structure within 2-4 weeks. This includes setting up logical hierarchies by department (Tax, Audit, Advisory), implementing tagging systems, and migrating critical documentation. Full adoption typically occurs within 2-3 months as teams become comfortable with the platform.

How does AllyMatter help with staff transitions when senior accountants retire?

The platform enables systematic capture of institutional knowledge through structured documentation templates and approval workflows. Senior staff can document complex processes, client-specific approaches, and nuanced interpretations before they leave. This knowledge remains searchable and accessible to remaining team members, preventing knowledge loss when experienced professionals retire.