Financial processes are the lifeblood of any organization, yet they remain surprisingly vulnerable to documentation chaos. When your finance team spends 40 minutes searching for the latest expense policy or struggles with inconsistent month-end procedures, it’s not just a minor inconvenience. It’s eroding your operational foundation.

For growing companies, these challenges compound exponentially. As your financial workflows evolve and your team expands, tribal knowledge becomes increasingly dangerous to rely on. Let’s explore how a centralized knowledge management approach transforms finance operations from a potential liability into a strategic asset.

Centralized financial policy management

Finance departments operate on precision, yet their critical policies and procedures often live scattered across shared drives, email threads, and team members’ personal documents. This fragmentation creates serious risks of outdated guidance and inconsistent application.

AllyMatter provides a single source of truth for all financial documentation. When your finance team updates expense policies, they don’t just revise an isolated document; they update the definitive reference that all departments access. This eliminates conflicting versions and ensures everyone follows current guidelines.

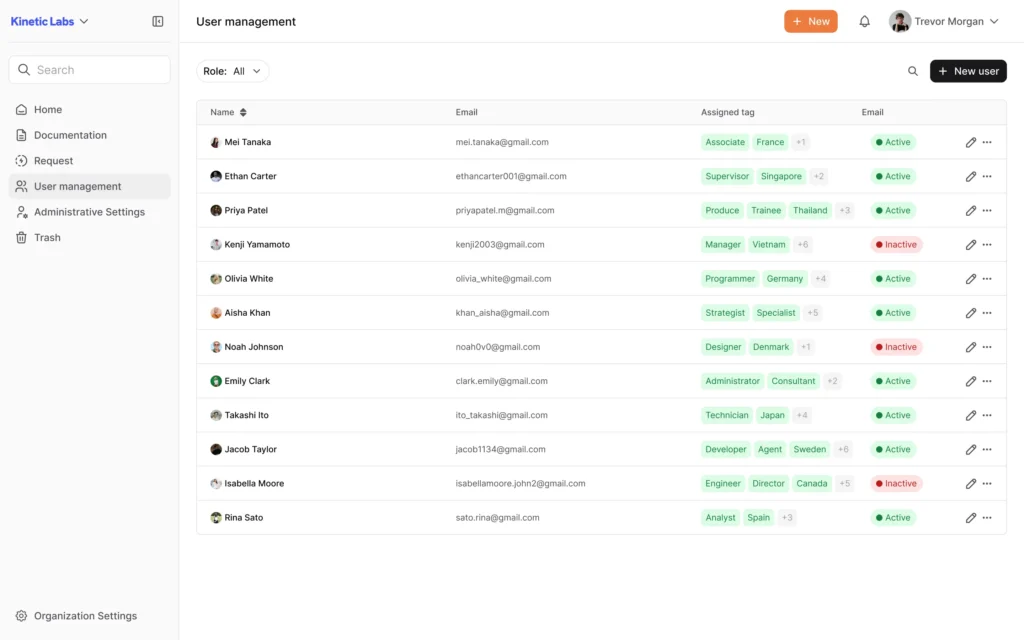

The platform’s intelligent organization features use smart tags, custom categories, and powerful metadata search to make locating specific financial documents intuitive. Finance teams can quickly organize month-end close procedures, reconciliation steps, accrual processes, and review protocols in logically structured, easily navigable sections.

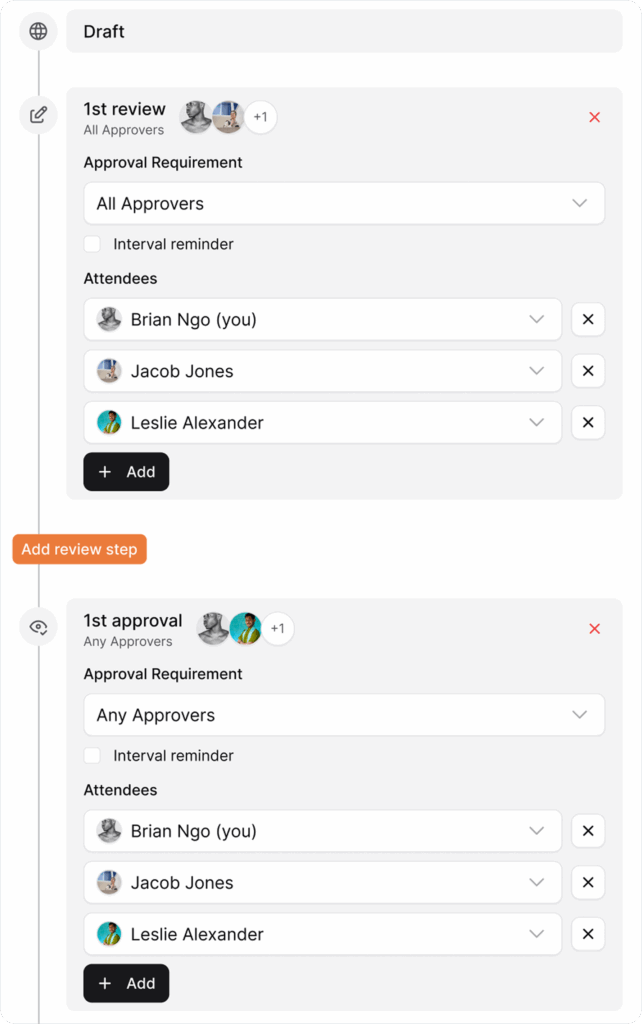

Streamlined approval workflows

Financial operations grind to a halt when approval processes become bottlenecks. Without clear, documented workflows, expense reports and vendor payments get trapped in confusing email chains and approval limbo.

AllyMatter’s smart approval flows automate these critical processes. The system creates transparent, structured pathways for reviewing and approving financial documents. Each step is clearly defined with appropriate permissions and responsibilities, eliminating confusion about who needs to approve what and when.

For example, a properly documented expense approval policy can specify different thresholds, required documentation, and approval chains based on amount and expense category. This creates consistency that protects the organization while enabling efficient operations.

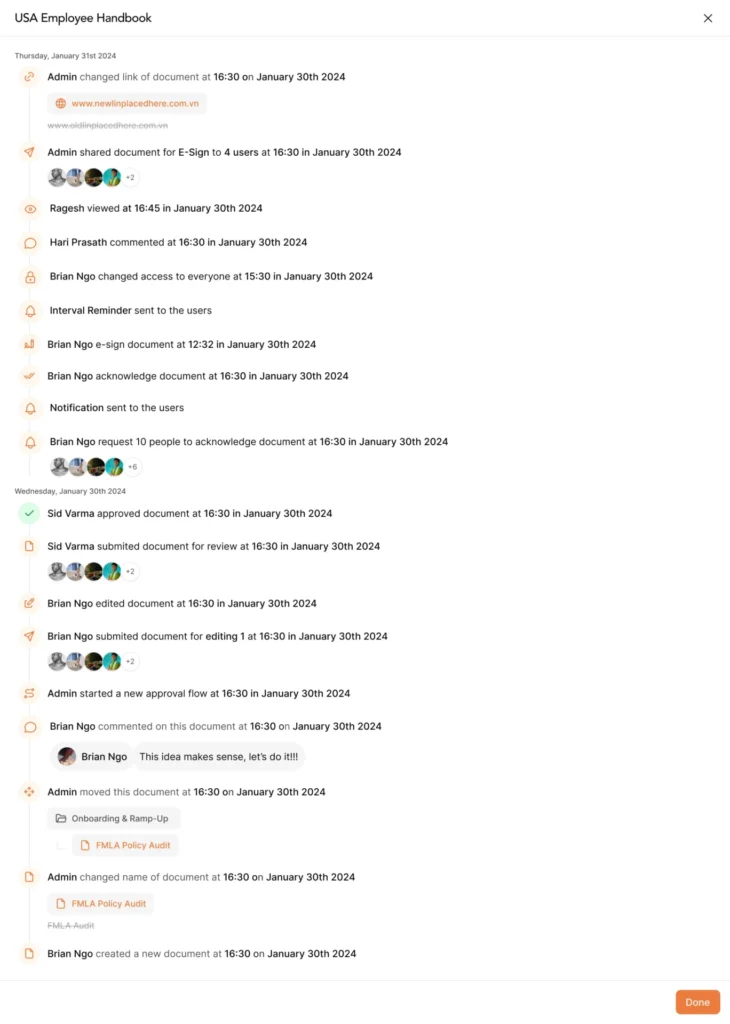

Comprehensive audit trails for compliance

The phrase “audit season” strikes dread in finance departments relying on scattered documentation. Preparing for auditors becomes a frantic scramble to assemble proof of compliant processes and appropriate controls.

AllyMatter transforms this reactive panic into proactive readiness through complete audit trails. Every document change, approval, and modification is automatically tracked and timestamped. This creates a chronological record that demonstrates proper oversight and change management.

For SOX compliance documentation especially, these audit trails prove invaluable. Finance teams can quickly demonstrate who made changes, when they occurred, and that appropriate approvals were obtained. This comprehensive tracking reduces audit preparation headaches while improving outcomes.

Secure document management with granular permissions

Financial documents present a particular security challenge. They must remain accessible to authorized personnel while protecting sensitive information from inappropriate access.

AllyMatter addresses this through granular access control tailored to roles and departments. For instance, global accounting standards documentation can use “Finance-Standards-Global” tags to ensure consistent practices, while SOX compliance documentation tagged with “Finance-Compliance-SOX” reaches only compliance teams and auditors.

The system enables finance leaders to protect sensitive financial information through:

- Role-based security policies that limit access based on job function

- Document-specific permissions for highly sensitive files

- Multi-factor authentication for enhanced protection of critical financial data

- Enterprise-grade encryption for data in transit and at rest

Standardized financial procedures across departments

As organizations grow, maintaining consistent financial processes becomes increasingly difficult. When teams interpret procedures differently or follow outdated versions, errors multiply and compliance risks increase.

AllyMatter ensures everyone accesses the same approved procedures and policy documents. This standardization is particularly critical for financial controls that protect the organization from errors and fraud.

For example, when documenting vendor payment processes, the knowledge base can include:

- Required documentation and approvals

- System entry procedures

- Reconciliation requirements

- Exception handling protocols

This level of detail eliminates uncertainty and ensures consistent execution regardless of who performs the task.

Efficient onboarding for finance team members

Financial roles require tremendous specialized knowledge before new team members become fully productive. Traditional onboarding often relies on shadowing and tribal knowledge transfer, creating inconsistent results and extending time-to-productivity.

With AllyMatter, finance departments create comprehensive onboarding documentation that accelerates skill development. New hires gain access to clear, step-by-step guides for critical financial functions and procedures.

Treasury procedure documentation serves as an excellent example. Rather than learning through observation or trial-and-error, new finance team members can refer to detailed workflows covering cash management, investment procedures, banking relationships, and forecasting methods.

Institutional knowledge retention

Finance departments face serious risk when key personnel depart. Without proper documentation, critical workflows, reconciliation methods, and decision frameworks leave with them.

According to a Panopto Workplace Knowledge and Productivity Report, 42% of institutional knowledge is unique to individual employees. When this knowledge isn’t documented, departures create significant operational disruption.

AllyMatter captures this tribal knowledge in documented procedures that remain with your company. Even when controllers, accounting managers, or financial analysts move on, their expertise continues benefiting the organization through well-documented processes and decision frameworks.

Enhanced interdepartmental collaboration

Finance interfaces with every department but often faces communication barriers when explaining policies and requirements. This creates friction, delays, and occasional compliance issues when other teams don’t understand financial guidelines.

AllyMatter bridges this gap by providing clear, accessible financial documentation for the entire organization. When developing budgets or implementing expense controls, finance can share relevant guidelines that explain not just procedures but also the reasoning behind financial controls.

For example, third-party financial procedures can provide vendors and customers with transparent guidelines for accounting, tax, and payment procedures. This clarity streamlines collaboration and ensures compliance with organizational financial requirements.

Budget process optimization

Budget creation and monitoring frequently suffers from ambiguity about roles, timelines, and required inputs. Without clear documentation, the process becomes unnecessarily stressful and prone to errors.

AllyMatter helps finance teams document exactly how budgets are created, approved, and monitored. This includes:

- Departmental input requirements and formats

- Review and approval workflows

- Key assumptions and calculation methodologies

- Variance tracking protocols

This documentation creates transparency that improves both the efficiency and quality of budget processes. Departments understand expectations, finance receives consistent inputs, and leadership gains clearer insight into financial planning.

Scaling financial operations with growth

Financial processes that function well for small companies often break under the strain of growth. As transaction volumes increase and operations become more complex, informal approaches fall short.

AllyMatter enables financial teams to document governance frameworks and controls that evolve with the organization. As complexity increases, these documented procedures ensure consistent application of policies regardless of scale.

For example, a growing company might evolve from simple approval thresholds to more nuanced decision-making matrices. Having these frameworks documented and accessible ensures consistent application across expanding operations while maintaining appropriate controls.

Transforming financial knowledge into organizational value

Finance teams hold critical knowledge that directly impacts organizational success. By centralizing, organizing, and securing this knowledge, AllyMatter transforms scattered financial expertise into a strategic asset that scales with your growth.

From ensuring compliance and streamlining operations to preserving institutional knowledge and enhancing collaboration, proper knowledge management elevates finance from a back-office function to a strategic driver of organizational success.

Ready to streamline your finance operations? Join our waitlist to be among the first to experience how AllyMatter transforms financial knowledge management for growing organizations.

Frequently asked questions

How does AllyMatter’s audit trail feature support financial compliance?

AllyMatter automatically tracks every document change, approval, and modification with timestamps and user attribution. This creates the comprehensive audit trail required for SOX compliance and simplifies audit preparation by providing chronological proof of proper oversight.

Can AllyMatter integrate with existing financial systems and workflows?

Yes, AllyMatter’s flexible architecture supports integration with common financial systems. The platform’s smart approval flows can work alongside existing ERP systems while providing enhanced documentation and audit capabilities that most financial systems lack.

How does AllyMatter’s access control protect sensitive financial information?

AllyMatter provides granular, role-based access controls specifically designed for financial documentation. You can set document-specific permissions, department-level access, and multi-factor authentication to ensure only authorized personnel access sensitive financial data.

What happens to our financial documentation if key finance team members leave?

All documented procedures, workflows, and institutional knowledge remain securely stored in AllyMatter’s centralized platform. This eliminates the risk of losing critical financial expertise when employees depart, ensuring operational continuity.

How quickly can finance teams implement AllyMatter’s documentation system?

Implementation timelines vary based on documentation complexity, but AllyMatter’s intuitive interface and migration support help finance teams organize existing documentation efficiently. Most teams see immediate benefits in document accessibility and workflow clarity.