When a customer calls about a complex claim and your agent can’t find the right policy interpretation document, that’s not just an inconvenience. It’s a moment that can damage customer trust and potentially cost your company thousands in mishandled claims.

According to McKinsey research, employees spend nearly 20% of their workweek looking for internal information, a challenge that’s particularly costly in insurance where accuracy and speed directly impact customer satisfaction and compliance.

AllyMatter’s knowledge management platform helps insurance companies overcome these critical challenges by centralizing documentation, streamlining processes, and preserving institutional knowledge.

Why insurance companies need better knowledge management

Insurance operations depend on accurate, accessible information. When knowledge is scattered across emails, shared drives, and outdated intranets, several problems emerge:

- Data silos create barriers between departments, making it difficult to coordinate on complex claims or policy updates.

- Agent onboarding becomes unnecessarily lengthy and inconsistent when new hires can’t access comprehensive training materials in one place.

- Customer service suffers when agents can’t quickly provide accurate information about policies or claims status.

- Compliance risks increase when teams work from outdated policy documents or miss regulatory changes.

How AllyMatter centralizes insurance documentation

AllyMatter provides a comprehensive internal knowledge base solution designed to address the unique documentation challenges insurance companies face:

Smart organization for quick information retrieval

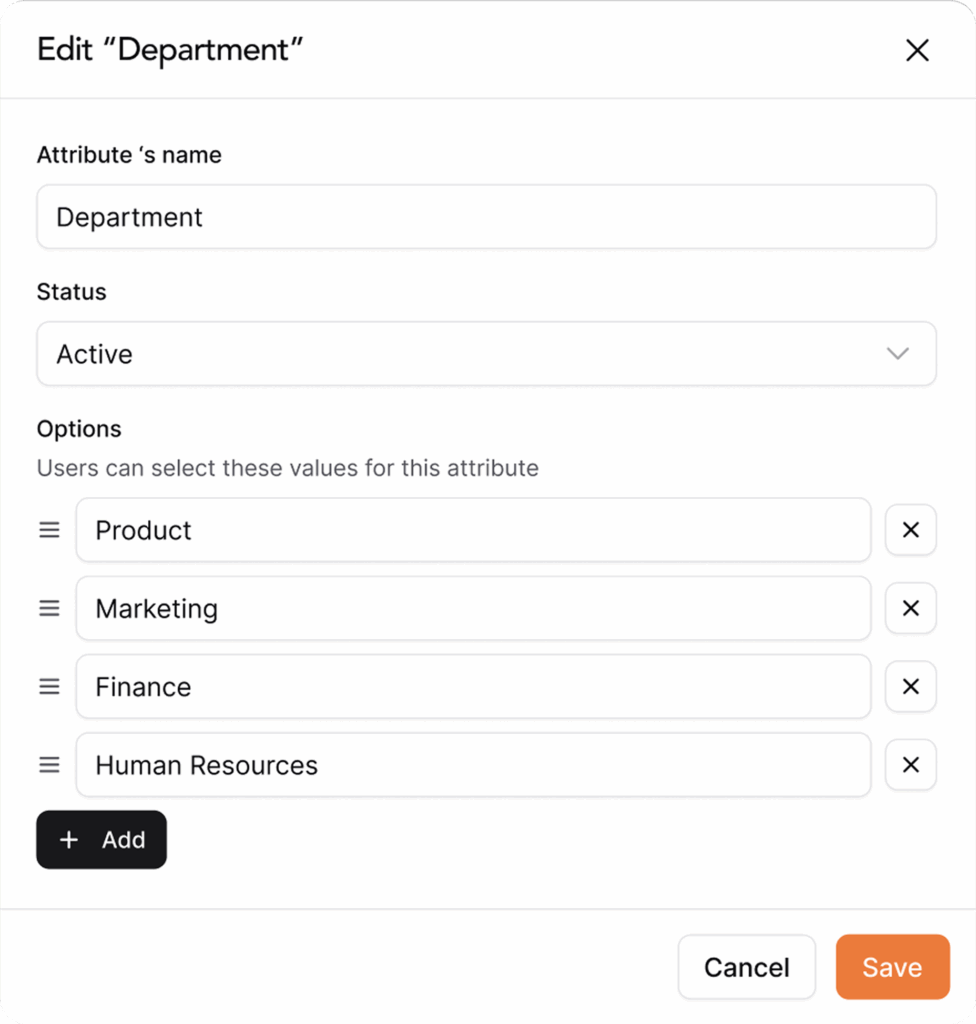

AllyMatter’s intelligent organization features help insurance teams classify and find documents quickly with:

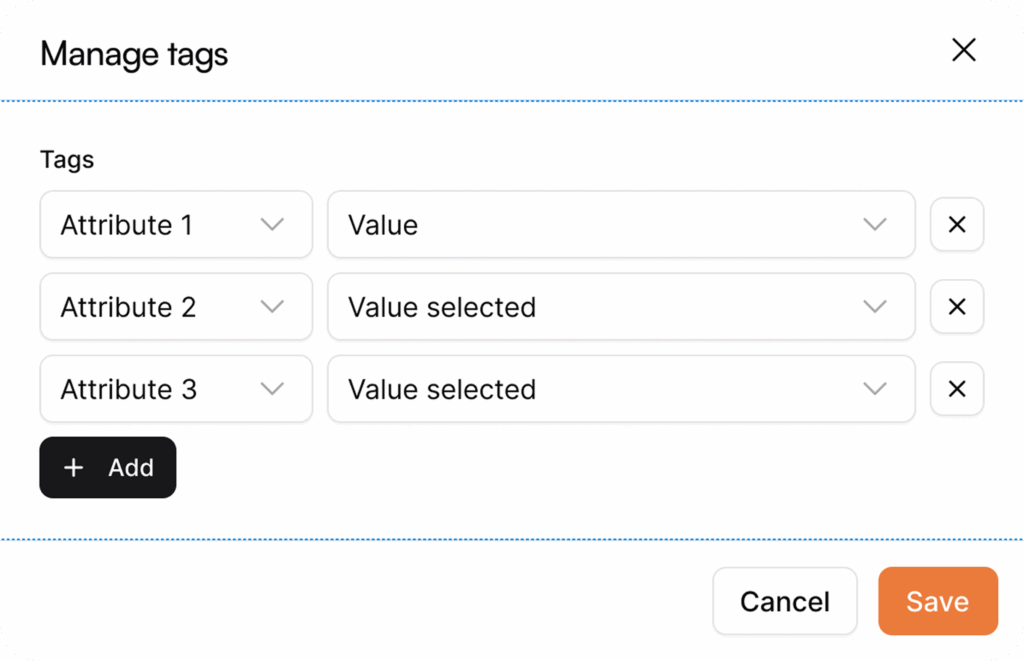

- Custom categories and department-specific tags for organizing policy documents, claims procedures, and training materials

- Powerful metadata search capabilities that allow agents to filter by relevant attributes

- Smart tags and custom categorization for organizing documentation based on your company’s specific needs

This means claims adjusters can immediately find the exact document they need instead of wasting valuable time searching through complex folder structures.

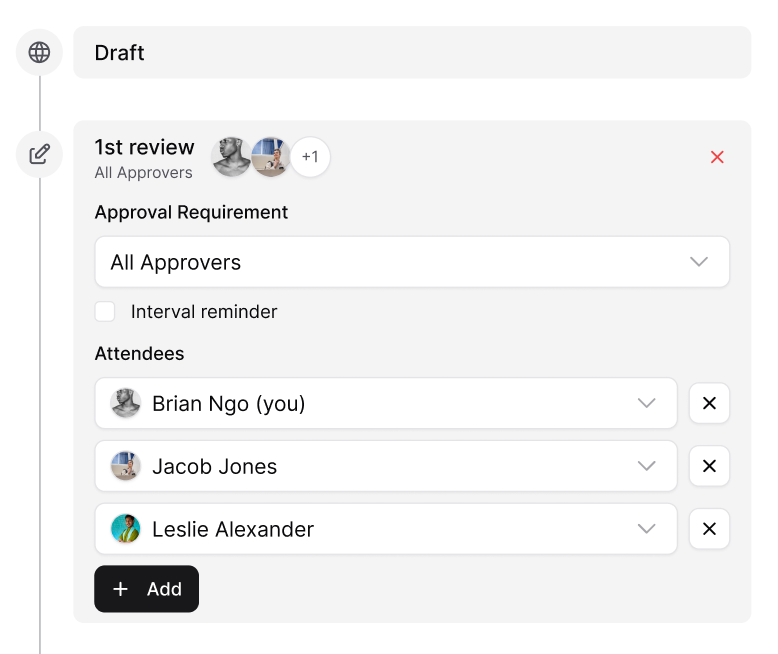

Streamlined approval workflows

Insurance documentation often requires careful review before implementation. AllyMatter’s approval workflow features ensure proper oversight:

- Automated workflows enable transparent, structured approvals for critical documents.

- Clear tracking shows each document’s progress through the review process.

- Configurable approval chains ensure all necessary stakeholders (claims managers, compliance officers, legal teams) are included.

This structured approach ensures consistent policy application and proper oversight of important documentation changes.

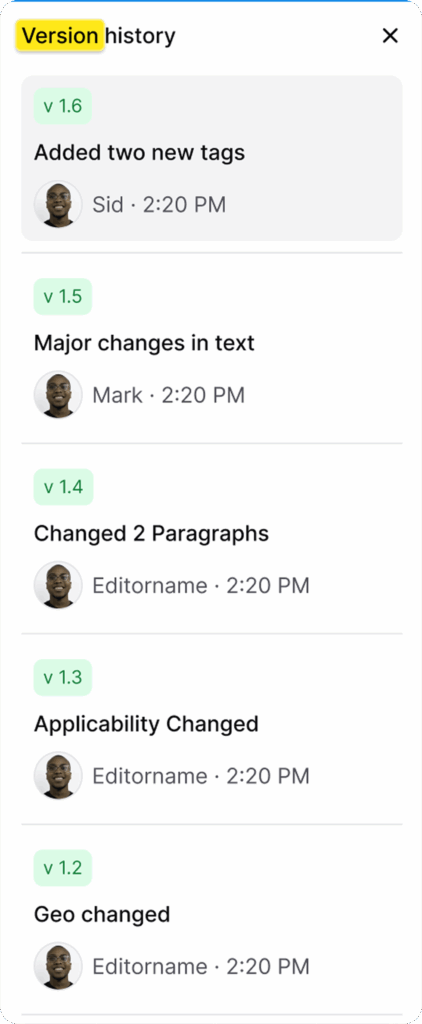

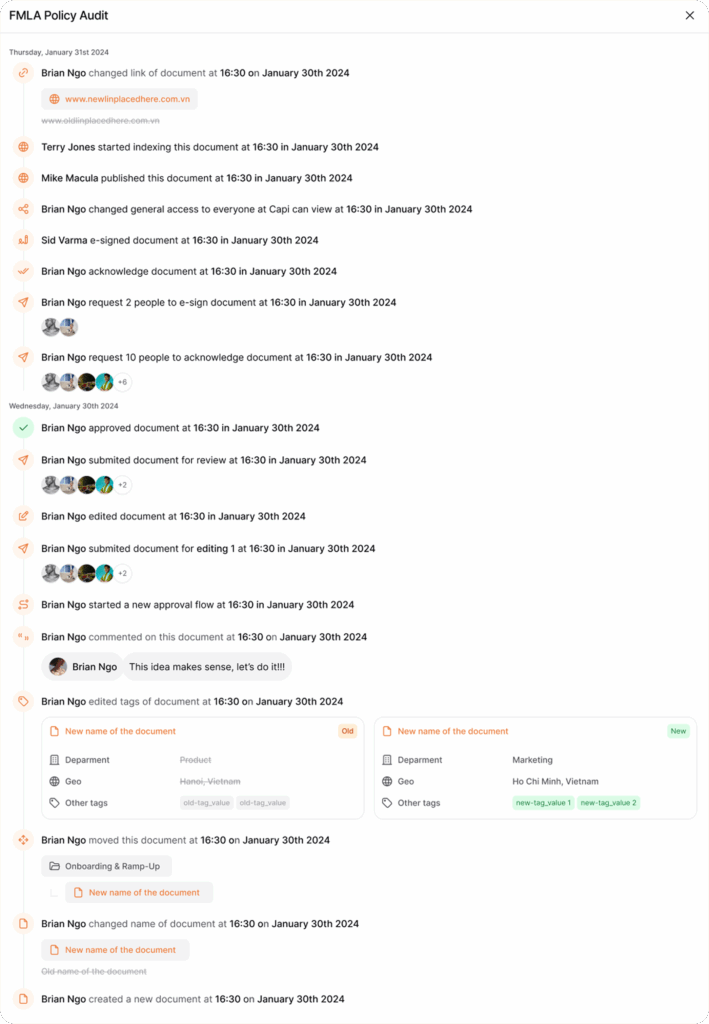

Version control and comprehensive audit trails

For insurance companies, maintaining clear records of document changes is crucial. AllyMatter delivers:

- Complete audit trails tracking every change for accountability and compliance

- The ability to compare document versions to see exactly what changed and when

- Historical access to previous versions for reference during audits or reviews

When auditors or regulators ask about policy updates, you can demonstrate precisely when changes were implemented and who authorized them.

Solutions for key insurance departments

AllyMatter provides targeted knowledge management solutions for different insurance teams:

For claims processing teams

Claims processing demands consistent application of procedures and quick access to policy interpretations. AllyMatter helps by:

- Creating a single source of truth for claims processing guidelines and coverage interpretations

- Ensuring all adjusters work from the same, current versions of documents

- Providing quick access to relevant procedures based on claim types and scenarios

Consider Megan, a claims adjuster handling a complex commercial property claim. She needs to verify coverage limits and exclusions, but the policy interpretation guidelines are scattered across three different systems. With AllyMatter, Megan would access all relevant documentation through a single search, reducing claim processing time and improving accuracy.

For HR and training departments

Insurance companies face constant challenges with agent onboarding and training. AllyMatter helps HR teams:

- Maintain a comprehensive repository of training materials and process documentation.

- Provide new agents with structured access to product information and procedures.

- Track acknowledgment of training completion and policy understanding.

With AllyMatter’s document management capabilities, HR teams can reduce onboarding time and ensure consistent knowledge transfer.

For compliance and legal departments

Insurance is heavily regulated, and compliance failures can be costly. AllyMatter helps legal and compliance teams:

- Manage regulatory documentation and internal policies with clear version control.

- Track employee acknowledgment of critical compliance documents.

- Maintain audit trails of all policy updates for regulatory reviews.

AllyMatter’s document signature and approval workflows ensure that compliance requirements can be properly tracked and verified.

Securing sensitive policyholder data

Insurance companies handle highly sensitive customer information. AllyMatter addresses these security concerns with:

- Granular access control that lets you assign document access rights tailored to roles and departments

- Enterprise-grade encryption for data protection both in transit and at rest

- Role-based security policies to limit access to sensitive information

These security features help insurance companies maintain both customer trust and regulatory compliance.

Improving customer experience

Better knowledge management directly improves your customers’ experience:

- When agents have immediate access to accurate information, they can resolve customer questions faster and with greater confidence.

- Consistent information across all channels, whether customers call in, visit an office, or use self-service options, builds trust in your company.

- Faster claims processing becomes possible when adjusters don’t waste time searching for the right procedures or policy interpretations.

Key features that make AllyMatter ideal for insurance companies

AllyMatter delivers specific features that address insurance industry knowledge management challenges:

Document visibility and access control

Insurance documents often contain sensitive information. AllyMatter allows you to:

- Set documents as fully public, internal-only, or private to specific users.

- Customize permissions with role-based access management.

- Monitor document access with detailed analytics for transparency.

Efficient collaboration

Team collaboration is essential in insurance operations. AllyMatter facilitates this with:

- Secure commentary and version control for team input on documents

- The ability for multiple stakeholders to contribute to policy updates

- Clear tracking of who made which changes to documents

Built-in signatures and approvals

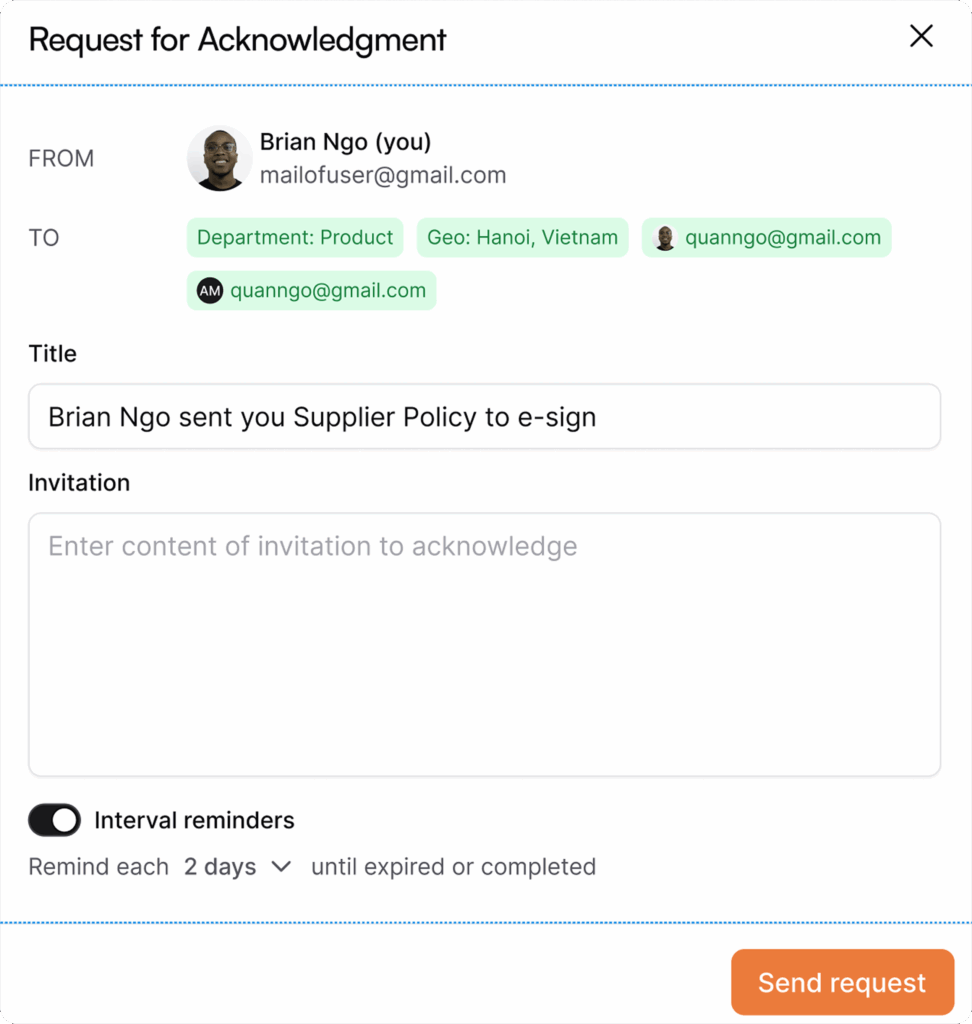

Insurance processes often require formal acknowledgment. AllyMatter provides:

- Built-in signature capabilities to document approval without leaving the platform

- Options for platform acknowledgment buttons, chat notifications, or integration with third-party e-signature tools

- Detailed tracking of who has acknowledged or signed each document

Take control of your insurance company’s knowledge assets

Knowledge is among an insurance company’s most valuable assets. When properly organized and accessible, it translates directly into operational efficiency and better customer experiences.

AllyMatter’s comprehensive knowledge management platform addresses the unique challenges facing insurance companies, from maintaining compliance to preserving valuable institutional knowledge as team members change.

By implementing a centralized internal knowledge base, your insurance company can reduce operational friction, improve customer satisfaction, and create a more efficient working environment for all team members.

Ready to transform how your insurance company manages knowledge? Join our waitlist to be among the first to experience AllyMatter’s specialized knowledge management platform designed for insurance operations.

Frequently asked questions

How long does it typically take to implement a knowledge management system for an insurance company?

Implementation timeframes vary based on company size and complexity, but most insurance companies can expect a phased rollout over 3-6 months. This includes data migration, user training, and system customization to meet specific departmental needs like claims processing and compliance requirements.

What security measures protect sensitive policyholder data in AllyMatter?

AllyMatter provides enterprise-grade encryption for data both in transit and at rest, granular access controls based on roles and departments, and comprehensive audit trails. These features help insurance companies maintain regulatory compliance with standards like GDPR, HIPAA, and other industry-specific requirements.

Can AllyMatter integrate with existing insurance management systems?

Yes, AllyMatter is designed to work alongside existing insurance software systems. The platform’s flexible architecture allows for integration with claims management systems, policy administration platforms, and customer relationship management tools commonly used in the insurance industry.

How does AllyMatter help with insurance regulatory compliance?

AllyMatter maintains complete audit trails of all document changes, provides automated approval workflows for policy updates, and enables tracking of employee acknowledgments for compliance training. This documentation helps insurance companies demonstrate compliance during regulatory audits and reviews.

What training is required for insurance staff to use AllyMatter effectively?

AllyMatter is designed with an intuitive interface that requires minimal training. Most insurance professionals can begin using basic features immediately, with advanced features like workflow configuration typically requiring 1-2 training sessions for administrators and department heads.