It’s 11 PM on a Thursday. You’re staring at your laptop, trying to remember how to categorize that AWS bill. Was it R&D or Operations? And what about that consultant payment – is that Professional Services or Contract Labor?

Your accountant sent you a template three months ago, but it’s buried somewhere in your email. Your co-founder keeps asking about burn rate, but pulling those numbers means diving into three different spreadsheets. And tomorrow, your new marketing hire wants to submit their first expense report, and you’ll have to walk them through the process… again.

Sound familiar? Welcome to the founder-doing-finance reality. You’re not just wearing the CFO hat – you’re wearing it while juggling five other roles and trying to build a company. The solution isn’t hiring a finance team (not yet) or spending weekends becoming a QuickBooks expert. It’s building a self-serve finance system that lets everyone find answers without hunting you down.

The real cost of ad-hoc financial management

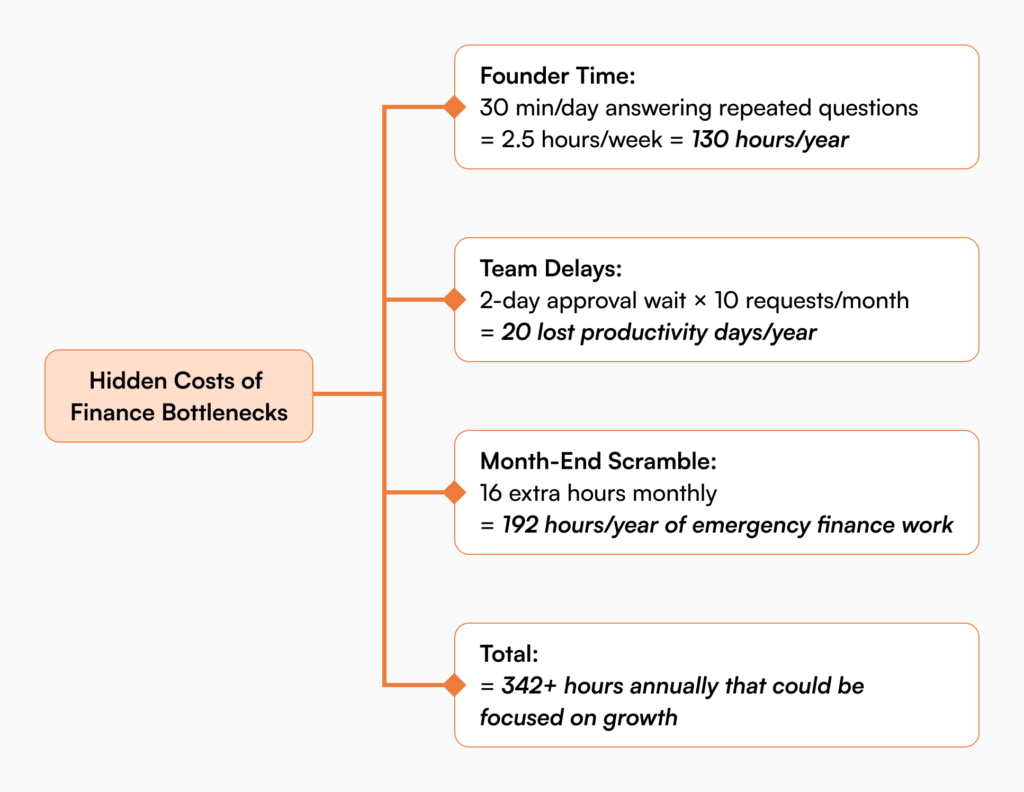

When finance processes live only in the founder’s head, the impact ripples through your entire startup:

Decision paralysis: Your team wants to make smart spending decisions, but they don’t know the budget, the approval process, or what’s considered a reasonable expense. So they either spend nothing (missing opportunities) or constantly interrupt you for approval on every $50 purchase. Neither approach scales.

The monthly scramble: Every month-end becomes a treasure hunt. You’re chasing down receipts in Slack, trying to remember what that $2,000 charge was for, and explaining to your accountant why there are three different “marketing” categories in your books. What should take two hours takes two days.

Fundraising fire drills: An investor wants to see your financials. Suddenly you’re scrambling to make sense of six months of transactions, creating retroactive budgets, and trying to explain why your burn rate varies wildly month to month. The chaos doesn’t inspire confidence.

Team frustration: Your team wants to be responsible with company money, but they can’t get clear answers. How much can they spend on tools? What counts as a reimbursable expense? When do they need approval? Without clarity, they either overspend or underspend – both hurt your startup.

Why founders resist finance documentation

Let’s be honest about why finance documentation usually gets pushed to the bottom of the priority list:

You’re not a finance person, and documenting processes you’re still figuring out feels premature. Plus, things change so fast – today’s expense policy might be irrelevant next quarter when you have different funding or priorities.

There’s also the fear that creating finance documentation means becoming bureaucratic. You left corporate to escape expense report hell, not to recreate it. The last thing you want is to slow your team down with red tape.

But here’s the thing: You’re already making financial decisions every day. Every time you approve an expense or explain how to submit an invoice, you’re creating a finance policy. The question is whether these policies are accessible to your team when they need them.

The five finance docs that create freedom

You don’t need a full financial procedures manual. These five documents will handle 90% of your team’s questions:

1. The expense & reimbursement playbook

This is your highest-impact document. Include:

- What’s reimbursable (with specific examples from your startup)

- Spending limits by category (tools, travel, meals, equipment)

- The submission process (where to send receipts, what info to include)

- Payment timeline (when people can expect reimbursement)

Real example: “Software tools under $50/month don’t need approval. Between $50-$500, check with your team lead. Over $500, flag to founders. Submit receipts via expense@[company] with a one-line description. Reimbursements process every two weeks.”

2. The vendor payment guide

Document how to handle the vendors and contractors that keep your startup running:

- How to submit an invoice for payment

- Required information for new vendors

- Payment schedules (NET 30, upon receipt, etc.)

- Who to contact with questions

Include templates for common scenarios. When your designer asks how to invoice you, they should find a clear answer without a back-and-forth email chain.

3. The budget reality check

You don’t need complex financial models. Start with:

- Current monthly burn rate

- Budget by department (even if informal)

- What constitutes “budget approval”

- How to request budget for new initiatives

Be transparent about constraints. “We have $X for marketing experiments this quarter” helps your team make informed decisions without constantly checking with you.

4. The financial calendar

Create predictability by documenting:

- When expenses need to be submitted

- Monthly close dates

- When financial reports are available

- Key financial milestones (tax deadlines, audit prep)

This prevents the month-end scramble and helps your team plan around financial deadlines.

5. The compliance checklist

Even early-stage startups have compliance requirements:

- How to handle receipts for tax purposes

- International payment considerations

- Contractor vs. employee guidelines

- Basic data security for financial info

Keep it simple but clear. “All receipts over $75 must include itemized details for tax compliance” is better than a lengthy tax code explanation.

Building your self-serve system

Creating documentation is just the first step. Here’s how to make it actually self-serve:

Start where the questions are: Look at your last month of Slack messages and emails. What finance questions came up repeatedly? Those are your highest-priority items to document. Don’t try to anticipate every scenario – document the ones actually happening.

Use real examples: Abstract policies confuse people. Instead of “Reasonable travel expenses are reimbursable,” write “Economy flights booked 14+ days in advance, hotels under $200/night in most cities (SF/NYC can go up to $300), meals up to $50/day when traveling.”

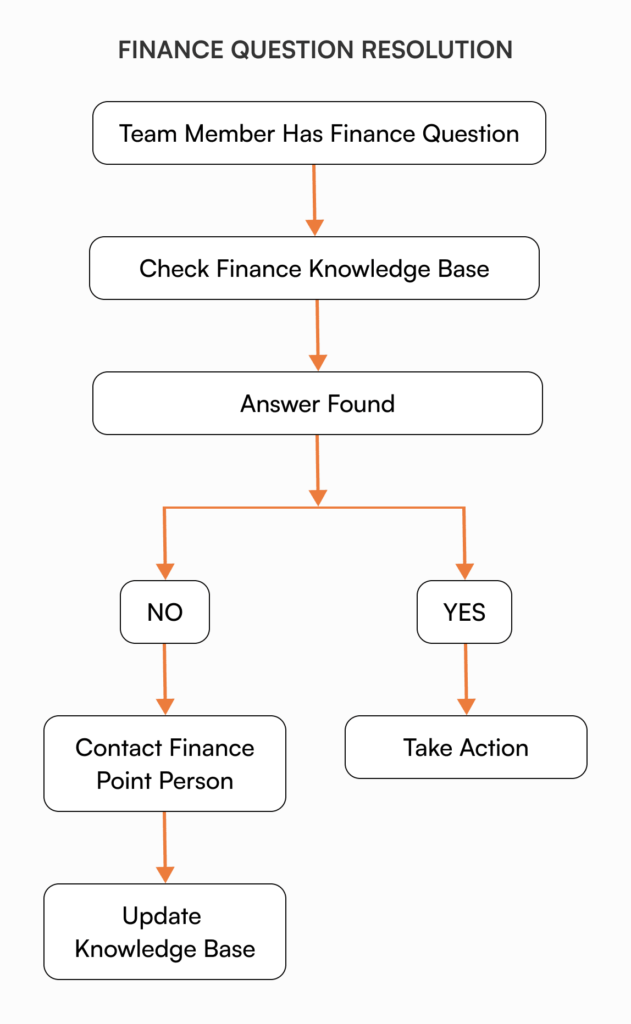

Create visual guides: Screenshot your expense submission process. Create a simple flowchart for approval levels. Visual documentation reduces confusion and follow-up questions dramatically.

Build in feedback loops: Add “Was this helpful?” to each document. When someone asks a question that should be answered in the docs, update the docs immediately. Your documentation should evolve based on actual use.

The tools that make it work

Your finance knowledge base doesn’t need to be fancy, but it needs to be findable and current:

Where to start: Begin with whatever your team already uses. If everyone’s in Notion, create a Finance space there. If you’re Google Docs people, create a clearly labeled folder. The best system is the one people will actually check.

Organization matters: Create a logical structure:

- Quick references (expense limits, payment schedules)

- How-to guides (submit expense, invoice the company)

- Policies (approval hierarchies, compliance requirements)

- Templates (invoice format, expense report template)

Keep it fresh: Set a quarterly reminder to review and update. Finance processes evolve quickly in startups. That tool spending limit might need adjustment after your Series A, or you might need international payment guides as you hire globally.

From chaos to clarity: Your implementation plan

Here’s how to build your self-serve finance system without dropping everything else:

Week 1: Document current state

- List your five most common finance questions.

- Write quick answers to each (15 minutes per answer).

- Focus on clarity over completeness.

Week 2: Organize and share

- Create your finance knowledge base structure.

- Upload initial documents.

- Share with the team at your next meeting.

- Assign a finance buddy who can help answer questions.

Month 1: Iterate based on use

- Track what questions still come to you.

- Update docs based on actual confusion.

- Add visual guides for complex processes.

- Celebrate when someone self-serves successfully.

Ongoing: Maintain momentum

- Monthly review of common questions.

- Quarterly update of all documentation.

- Annual deep dive on process improvements.

When spreadsheets and docs aren’t enough

As you grow, managing finance documentation becomes more complex. You’ll have multiple versions of policies, no clear audit trail of who approved what, and tracking who’s actually read the latest expense policy becomes impossible.

This is where dedicated knowledge base tools like AllyMatter help. Instead of static documents that no one knows are current, you get version control showing what changed and when. Approval workflows ensure financial policies are reviewed before going live. When policies update, automatic notifications ensure everyone knows. Most importantly, you can track who’s acknowledged critical compliance documents.

The goal isn’t to add bureaucracy; it’s to maintain the self-serve efficiency you need while adding the controls investors and auditors expect.

Discover more: Transform Financial Knowledge Into Audit-Ready Operations

The multiplier effect

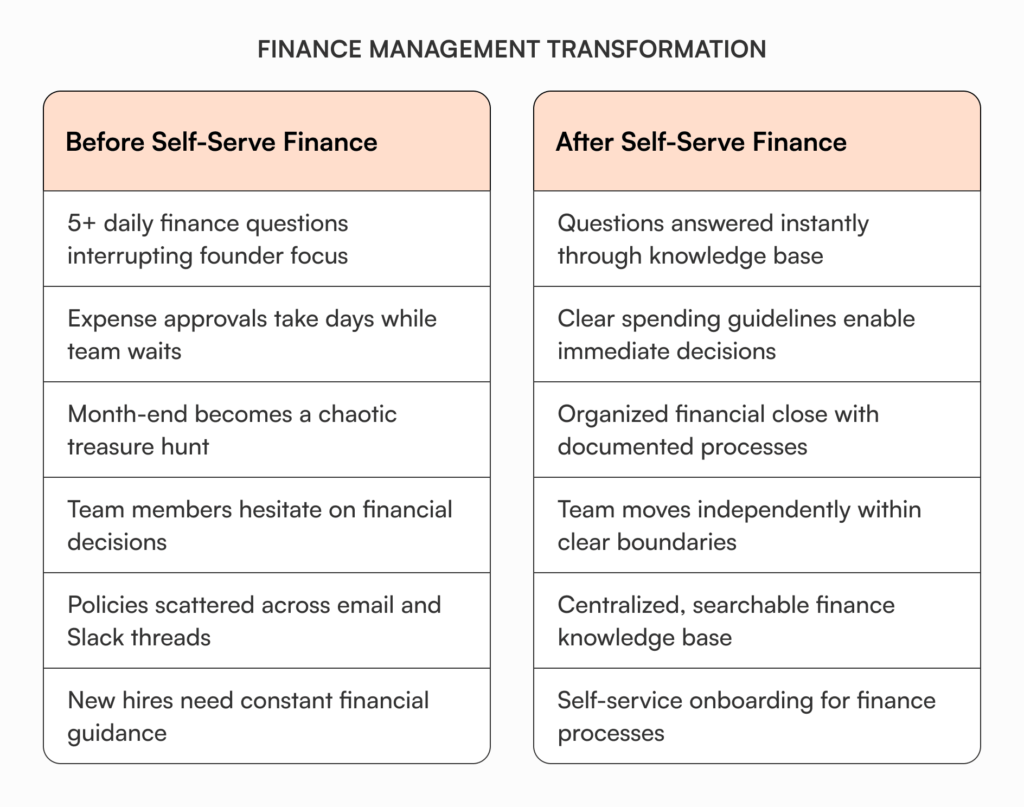

Here’s what happens when you nail your finance knowledge base:

Time savings: Those five daily finance questions? They disappear. That’s 30 minutes back every day to focus on growth.

Team empowerment: Your team makes faster, more confident decisions. They know the boundaries and can move quickly within them.

Sarah, a marketing manager at a fast-growing SaaS startup, needed to purchase a new design tool. Instead of waiting two days for founder approval, she checked the finance knowledge base, confirmed the $89/month tool fell within her pre-approved budget limits, and had the team use it the same day. The result? A campaign launched on schedule instead of delayed by approval bottlenecks.

Investor readiness: When due diligence comes, you’re not scrambling. Your processes are documented, clear, and professional.

Scalability: New hires can onboard themselves financially. Your next finance hire inherits a system, not chaos.

Start today, thank yourself next month

Building a self-serve finance system isn’t about becoming a financial expert or creating bureaucracy. It’s about documenting the decisions you’re already making so your team can move fast without constant check-ins.

Start small. Pick your most annoying repeated finance question and document the answer. Share it with your team. Then document the next one. Within a month, you’ll have transformed from the finance bottleneck to the founder who enabled their team to self-serve.

Your future self – the one not answering expense questions at 11 PM – will thank you.

Ready to transform your finance chaos into streamlined self-service? Join the AllyMatter waitlist

Frequently asked questions

How do I prevent my finance knowledge base from becoming outdated as my startup grows?

Set quarterly review cycles and assign ownership to your finance point person or whoever handles financial decisions. As your startup scales, processes change quickly, so build update triggers into your workflow – when you change an expense policy or adjust spending limits, update the documentation immediately rather than waiting for scheduled reviews. Use version control to track changes and ensure team members always access current information. Most importantly, treat your finance knowledge base as a living system that evolves with your business needs.

What’s the difference between documenting finance processes and creating unnecessary bureaucracy?

Documentation creates clarity and speed; bureaucracy creates barriers and delays. Focus on documenting decisions you’re already making daily – approval limits, reimbursement processes, vendor payment timelines. If a document helps team members act faster and more confidently without hunting you down, it’s helpful documentation. If it slows them down with unnecessary approval steps or complicated procedures, it’s bureaucracy that will hurt your startup’s agility.

Should I wait until I have more financial expertise before documenting finance processes?

Start documenting now, even if processes feel informal or you’re still learning. You’re already making financial decisions daily – expense approvals, vendor payments, budget allocations. The documentation simply makes those decisions accessible to your team when you’re not available. As your expertise grows through experience or hiring financial professionals, your documentation can evolve alongside your knowledge. Early documentation prevents knowledge silos and reduces founder bottlenecks as you scale.

How detailed should my expense and reimbursement guidelines be for a small team?

Keep guidelines specific enough to prevent confusion but flexible enough to handle edge cases. Include dollar limits by category (software tools, travel, meals, equipment), submission processes with clear timelines, and real examples from your startup’s actual expenses. For a 10-person team, “Software under $50/month needs team lead approval, over $50 needs founder approval” works better than vague “reasonable business expenses.” You can always add detail as questions arise.

What finance information should I keep private versus share with my team?

Share operational information that helps your team make smart decisions – budget guidelines, expense policies, vendor payment schedules, and general cash runway (“we have X months of runway at current burn”). Keep sensitive strategic information private – detailed financial projections, specific investor discussions, exact cash balances, and individual salary information. The goal is transparency that empowers decision-making without oversharing confidential business details.

How do I handle international payments and contractors in my finance documentation?

Document your current approach, even if it’s basic. Include required information for international vendors (tax forms, payment methods, currency preferences), typical payment timelines (international wires take longer), and any compliance requirements you’re aware of. For contractors, clarify the difference between contractor and employee classifications, as this affects both payments and tax obligations. As you work with more international vendors, expand this section based on actual experience.